FPI empfiehlt, die 3 Artikel sorgfältig zu lesen – dort sind sehr deutlich die wesentlichen Punkte dargestellt – und auch die Dringlichkeiten. <<< Interessant wie die Situation wird, wenn das 500-%-Zoll-Tarif-Gesetz in Kraft ist – sic!= das die USA umsetzen wollen, und wo die Europäer die USA drängen es doch endlich umzusetzen.

FPI erlaubt sich auf diese Artikel hinzuweisen – Artikel 1, Artikel 2, Artikel 3.

https://economictimes.indiatimes.com/industry/auto/china-rare-earth-minerals-export-xi-jinping-global-supply-chain-electric-vehicles-impact/articleshow/121614452.cms?from=mdr

https://economictimes.indiatimes.com/news/international/global-trends/global-alarms-rise-as-chinas-critical-mineral-export-curbs-takes-hold/articleshow/121611145.cms

https://economictimes.indiatimes.com/industry/auto/auto-news/magnet-crisis-auto-giants-rush-to-china-for-rare-earth-rescue/articleshow/121525090.cms?from=mdr

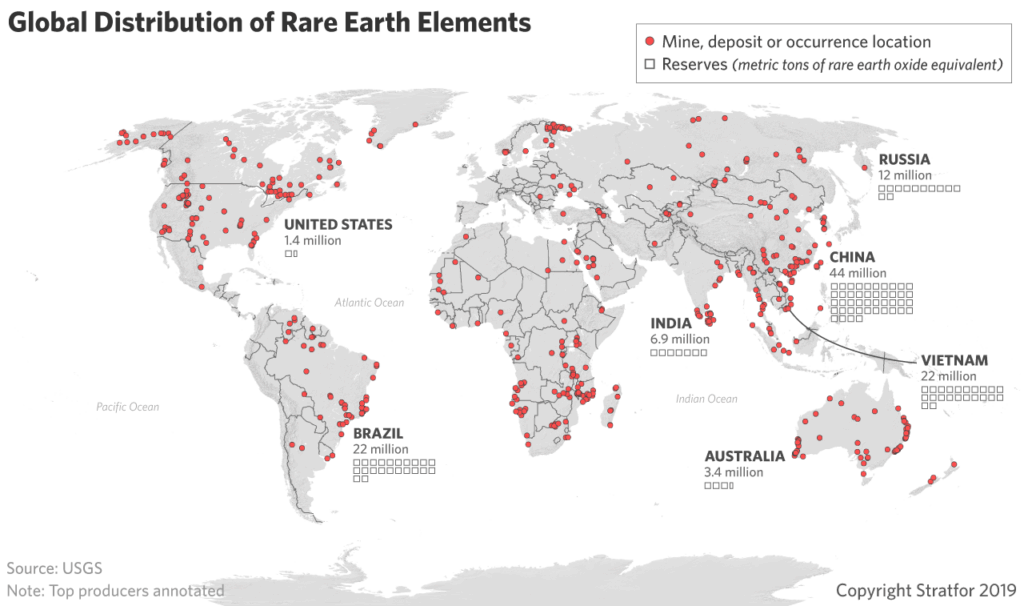

The restrictions, which took effect on April 4, mandate special export licences for seven rare earth elements (REEs) and related magnets, citing national security and non-proliferation concerns. According to the International Energy Agency and the United States Geological Survey (2025), China still produces 60% of the world’s REEs and controls a staggering 90% of global refining capacity.

The critical materials, including samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium, are essential in electric motors, braking systems, smartphones, aerospace components, and missile technology.

Mountain Pass, the United States’ only operating rare earth mine, still depends on Chinese processors. Even MP Materials’ upcoming facility in Texas will only produce 1,000 tonnes annually by 2027. In comparison, China produces 300,000 tonnes, according to Bloomberg.

The supply crunch is already prompting global manufacturers and trade bodies to seek urgent interventions. As Reuters reported, diplomats, automakers, and industry executives from India, Japan, and Europe are urgently seeking meetings with Chinese officials to expedite stalled export licences. A Japanese business delegation is expected in Beijing in early June, while European envoys have requested “emergency” meetings on the issue.

On Tuesday, Hildegard Müller, head of Germany’s powerful automotive lobby, echoed that concern. “If the situation is not changed quickly, production delays and even production outages can no longer be ruled out,” she said, as reported by Reuters.